Hiya pricey readers and good people.

Right here we’re – but once more – because it’s time for one more riveting replace from yours really.

As is the norm nowadays, this one is a bit delayed, as we’ve been on a getaway to “the promised land”. We didn’t fairly get what we have been promised although – however we did get some solar and a few good wanted relaxation AND a break from the Danish winter-weather. I additionally managed to learn 3 books in 1 week. I really like studying, however for some cause I can solely actually “focus” on doing it after I’m on trip…

Since we left Denmark on the finish of February, I didn’t get the possibility to investigate cross-check my portfolios across the twenty eighth, and sadly the start of March has not been variety to our portfolios.

We’ve been busy with getting ready our dwelling to get listed, and we’re now nearly prepared to go surfing. I’m nonetheless fairly weary about the entire state of affairs (all the time the pessimist) and don’t actually know what to anticipate. Anyway, I attempt to stay hopeful that there’s going to be a purchaser on the market – on the proper worth.

In the meantime, we employed a constructing inspector to undergo the home that we have been planning to purchase (as an alternative of our present dwelling). He discovered main points, so now “the dream dwelling” has was a little bit of a dud. This has sort of put a little bit of a stick within the wheel, by way of our future plans. The “low-cost dwelling” that we have been planning to maneuver to, which was near our daughters college, now not exists…This home was the entire foundation for our shifting plans. So now…the whole lot is sort of up within the air once more. Anyway, step one to shifting wherever is to promote our present dwelling, in order that shall be our focus for the approaching months

One other shite-month within the markets. I don’t have quite a bit so as to add, apart from I’m beginning to get actually sick and uninterested in it!

Additionally, the CAD->EUR trade charge has dropped 5% in 1 yr, so my CAD dividend portfolio is bleeding cash in the intervening time. I’m beginning to suppose that I ought to give up the forex race, and simply promote the whole lot and put it into my checking account. At the very least right here I get 1.5% However who am I to run away when the going will get powerful? I believe I must persist with it for a short time longer (no less than till Property #2 presents itself, and I’d want the cash right here as an alternative?…).

Anyway, I really feel like I simply have to get this one off the ramp, and as soon as once more level out that in any case nearly all of our investments are safely positioned in a property, which is presently spitting out money sooner than the markets can drop! (HA!). I obtained phrase from the board (of the corporate that I personal 10% of – which then owns Property #1) that we’re going to try a remortgage and a full re-leverage (that means we are going to re-mortgage again to the unique 70% of the property worth). This isn’t till October although, however the determination shall be made throughout summer time. At present we’re an curiosity improve from 1.38% to 4.10%. Ouch. Fortunately the corporate will nonetheless be (very) worthwhile, even at this rate of interest, as a result of we’ve additionally raised the lease by 4.5% due to inflation. Hooray for CPI-adjusted leases!

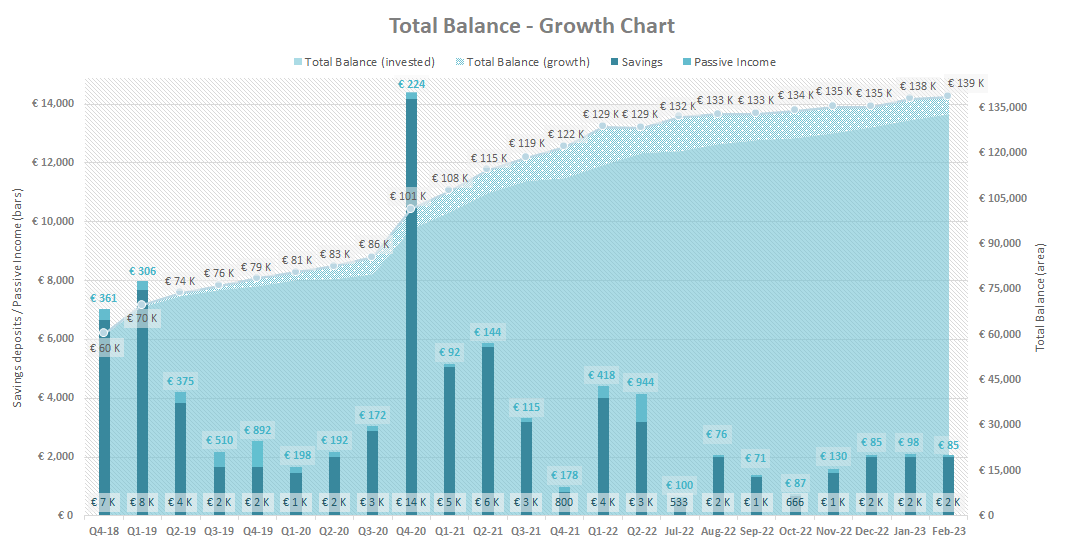

I’l be utterly frank (in New York I’m Frank, in Chicago I’m Earnest – get it? ) right here: it’s sort of irritating to be placing €2,000 into your financial savings and solely see the Whole Steadiness develop by €573! Oh nicely, higher luck subsequent time, proper!?

| Platform | Invested | Transactions | Final month | Present worth | Month-to-month earnings |

| Commodities | |||||

| GOLD (Cash) | € 5,333 | € 0 | € 6,500 | € 6,500 | |

| € 6,500 | € 6,500 | ||||

| Shares (Dividend portfolio) | |||||

| Financial institution of Nova Scotia (BNS) | € 1,000 | € 0 | € 1,243 | € 1,250 | € 0 |

| Enbrigde (ENB) | € 2,400 | € 0 | € 2,243 | € 2,102 | € 0 |

| PROREIT (PRV.UN) | € 2,018 | € 0 | € 4,028 | € 3,826 | € 17 |

| Toronto Dominion Financial institution | € 1,000 | € 0 | € 1,076 | € 1,049 | € 0 |

| TransAlta Renewables (RNW) | € 2,000 | € 0 | € 1,643 | € 1,557 | € 8 |

| True North Business REIT (TNT-UN-T) | € 3,552 | € 0 | € 3,144 | € 3,044 | € 19 |

| € 13,377 | € 12,828 | € 44 | |||

| Shares (Indices) | |||||

| iShares International Clear Vitality (IQQH) | € 6,667 | € 7,803 | € 6,926 | € 0 | |

| Xtrackers MSCI World ESG (XZW0) | € 2,721 | € 2,426 | € 2,349 | € 0 | |

| € 10,229 | € 9,275 | € 0 | |||

| Properties | |||||

| Property #1 | € 68,667 | € 0 | € 68,667 | € 68,667 | € 0 |

| € 68,667 | € 68,667 | € 0 | |||

| Crypto | |||||

| Nexo (BTC, ETH, MATIC, EURx) | € 0 | € 724 | € 756 | € 4 | |

| € 724 | € 756 | € 4 | |||

| Money | |||||

| Financial institution #1 money (major financial savings) | € 0 | € 2,415 | € 0 | € 0 | |

| Financial institution #2 Alternative cash | € 2,000 | € 35,834 | € 40,249 | € 37 | |

| Dealer account (CAD, EUR, DKK) | € 44 | € 291 | € 335 | € 0 | |

| € 38,540 | € 40,584 | € 37 | |||

| Whole steadiness | € 138,037 | € 138,610 | € 85 |

Somewhat below-average passive earnings month this month, however the financial institution curiosity is slowly starting to grow to be a major a part of my passive earnings. I do know that 1.5% is foolish little, nevertheless it feels quite a bit higher than loosing 1.5% (or extra) to the inventory market I’m fairly pleased with not being absolutely invested throughout these unstable days/months. 2023 is inconceivable to learn at this level, so I favor to maintain accumulating money over the rest. I stay on the right track for a mean of €2,000 in month-to-month financial savings deposits. I hope to stick with it, however whether or not it is going to be potential will all rely upon WHEN/IF the home transfer is presently to materialize this yr or not…

As all the time, I embody the Basic Development Charts for monitoring objective:

I’m uninterested in watching my portfolio decline month after month! However such is the sport – it’s lengthy and arduous

Nothing thrilling or out of the odd occurred in February – besides that our “subsequent dwelling hope” died with an inspection that pinpointed extreme damages beneath the floor of the home (actually). So now we don’t actually know what to do IF we handle to promote our personal home. There’s presently no different home within the space the place we need to dwell that’s in our worth vary (thoughts you that we need to purchase a CHEAPER place than the one we’ve got now). I’ll put my belief and religion in The Universe that it’s all going to work out in the long run

See you subsequent month for one more riveting replace from yours really!

How was your month?