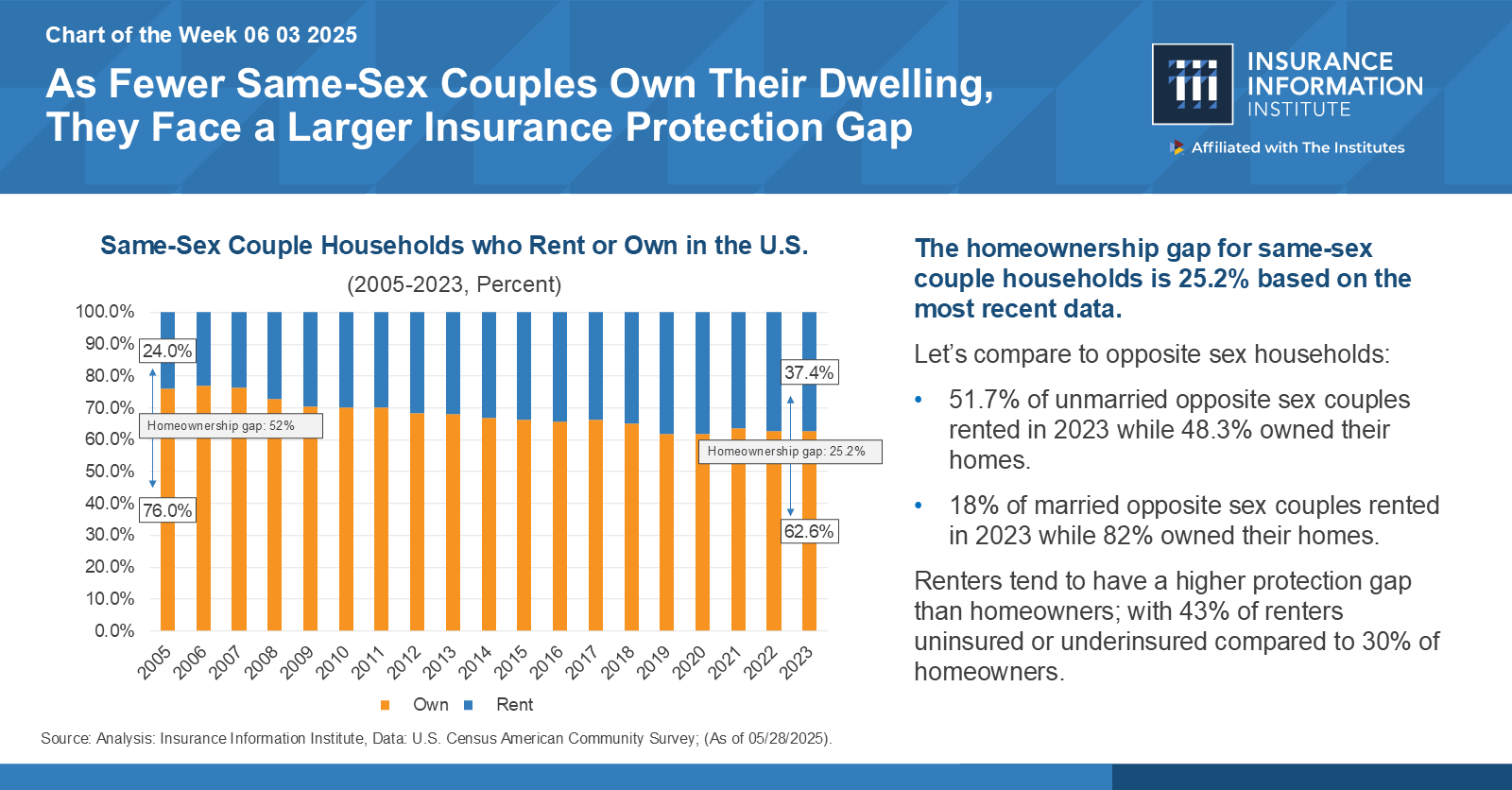

As a part of an ongoing dialogue on the hyperlink between the housing and insurance coverage markets, the Insurance coverage Data Institute (Triple-I) launched a Chart of the Week (COTW), “As Fewer Similar-Intercourse {Couples} Personal Their Dwelling, They Face a Bigger Insurance coverage Safety Hole.” Based mostly on knowledge from 2023, 62.6 % of same-sex households personal their properties and 37.4 % lease, representing a homeownership hole of 25.2 proportion factors inside this neighborhood. Compared, 82 % of married opposite-sex households personal their properties, whereas solely 18 % lease.

In america, homeownership presents a number of advantages (versus renting) to these with the monetary assets to attain and maintain it. House owners can accrue fairness to extend their probabilities of making a revenue after they promote their house. They will reap tax advantages by means of mortgage deductions. Mortgage holders can even decrease month-to-month housing prices when rates of interest drop. In the end, a house can enhance private internet price and supply a mechanism to switch wealth to the following era. Defending this asset and its contents makes good monetary sense.

Renters might not personal their dwelling, however they preserve private belongings in it. They will face critical monetary dangers within the occasion of a loss, theft, catastrophe, or private legal responsibility occasion. But, based on the COTW, 43 % of renters are uninsured or underinsured, in comparison with 30 % of householders. There are a number of causes attributable to this distinction, nevertheless it’s important to maintain one on the forefront: insurance coverage protection necessities are commonplace in mortgage agreements however not in lease agreements. Thus, homeownership standing can drive participation within the insurance coverage market.

Inspecting components that impede homeownership for same-sex {couples} would possibly make clear the right way to entice and retain extra policyholders on this demographic. Wanting intently on the interaction of simply three of those – housing costs, geography, and legislative surroundings – reveals that housing tends to be costlier in LGBTQIA+-friendly areas. Potential consumers might have to earn not less than $150,000 a yr – as a lot as 50 % extra – to keep away from dwelling in areas with out fundamental authorized protections, based on a latest research of actual property market knowledge throughout 54 main U.S. metropolitan areas.

Excessive month-to-month housing prices pressure budgets, pushing householders and renters out of the insurance coverage market. It could additionally put the monetary {qualifications} for house shopping for – i.e., constructing credit score and financial savings – out of attain. Households are thought-about cost-burdened after they spend greater than 30 % of their revenue on lease, mortgage funds, and different housing prices, based on the U.S. Division of Housing and City Growth (HUD).

Nationwide, renters had larger median housing prices as a proportion of their revenue (31.0 %) in comparison with householders (21.1 % for householders with a mortgage and 11.5 % for these with no mortgage). In metropolitan areas that welcome and shield variety, renters usually tend to be housing cost-burdened, significantly in New York (52.1 % of residents pay greater than 30 % of their revenue) and San Francisco (37.6 % of residents). Renters in states and municipalities the place laws is significantly much less welcoming however rents are decrease can face comparatively larger premiums for rental protection.

Regardless of the legalization of same-sex marriage and numerous anti-discrimination legal guidelines, the LGBTQ neighborhood nonetheless battles appreciable discrimination and systemic biases in lots of areas of life, together with housing. Insurers can work to higher perceive the various wants of LGBTQIA+ people, {couples}, and their households, facilitating simpler options for managing monetary dangers. And most significantly, the business can enhance communication round potential protection advantages for these households.

“We are able to begin closing the safety hole by having folks on the desk who perceive the lived experiences behind the numbers,” says Amy Cole-Smith, Govt Director for BIIC/ Director of Range at The Institutes.

For instance, renters would possibly discover it useful to know their coverage covers a loss occasion linked to discrimination towards them, resembling malicious harm or vandalism to the property by a 3rd celebration. Even when it’s evident the destruction isn’t the renter’s fault, the owner would possibly nonetheless try to carry them accountable, both by means of a lawsuit, a lease enhance, or eviction. Moreover, single {couples} needs to be knowledgeable about whether or not the insurer consists of each companions’ names on a coverage and the way this provision impacts them within the occasion of a declare.

“Cultivating an inclusive workforce drives smarter options, like renters’ insurance coverage that aligns with the realities of same-sex {couples}, extra equitable underwriting, and advertising that actually resonates,” Cole-Smith says. “This isn’t nearly fairness—it’s about unlocking development and staying aggressive in a altering market. When the insurance coverage workforce displays the variety of the market, we’re in a stronger place to construct merchandise that meet folks the place they’re.”

Triple-I works to advance the dialog round essential points within the insurance coverage business, together with Expertise and Recruitment. To affix the dialogue, register for JIF 2025. We additionally invite you to comply with our weblog to be taught extra about developments in insurance coverage affordability and availability throughout the property/casualty market.