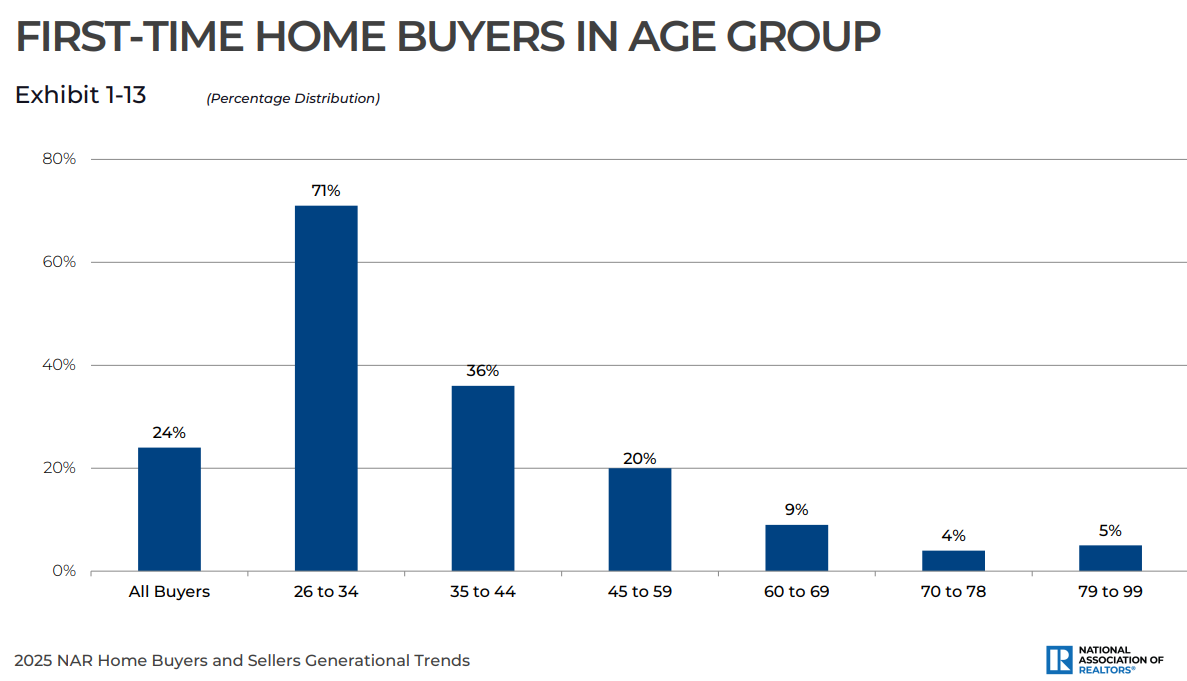

In accordance with the Nationwide Affiliation of Realtors, first-time homebuyers fabricated from simply 24% of latest transactions:

That’s the bottom on file because the NAR has been accumulating this knowledge since 1981. Almost three-quarters of latest patrons didn’t have a toddler underneath the age of 18 of their dwelling, the very best share on file.

It’s a horrible time to be an adolescent seeking a home.

Simply take a look at the newest knowledge from Redfin for the month-to-month mortgage cost on a median dwelling at prevailing rates of interest:

The median month-to-month cost has almost doubled because the begin of 2022 alone. Issues are even worse going again to 2020 or 2021.

The end result right here is the median age of first-time homebuyers has gone approach up in recent times. Right here’s the pattern from Lance Lambert:

It’s elevated from 33 in 2020 to 38 now.

Almost 30% of individuals 26 to 34 who have been capable of purchase a home wanted assist with the down cost from a relative or buddy.

Once you mix the large enhance in housing costs with the large enhance in mortgage charges, that is seemingly the worst time ever to be a first-time homebuyer. Positive, if you happen to purchase now and might refinance at decrease charges down the road issues will in all probability work out for you simply wonderful.

However many younger folks merely can’t afford to purchase proper now as a result of down funds are too excessive and borrowing prices are too onerous. It must be such a irritating scenario as a result of it’s not your fault if you happen to have been born a number of years too late for the most important housing increase in historical past.

I do know loads of younger individuals are offended about housing prices however this doesn’t really feel like a difficulty that’s high of thoughts for native governments, the federal authorities or policymakers. Everybody is aware of housing it cost-prohibitive for younger folks however nobody is de facto doing a lot about it.

Why is that?

A part of the reason being most individuals already personal a house:

Owners are content material with the present scenario so long as they’re not compelled to promote and purchase a brand new place. Housing costs are up rather a lot and most households have been capable of lock in a lot decrease mortgage charges in the course of the pandemic.

There’s some sympathy for individuals who missed out however the majority of householders are fairly pleased with the present scenario. Positive, some folks seemingly really feel trapped of their present dwelling as a result of they’ve a 3% mortgage or can’t afford to commerce up right into a costlier dwelling with a 7% mortgage.

However that’s significantly better than being boxed out of a home altogether.

It seems like we’re going to be in a scenario the place the one individuals who can afford to purchase are those that:

- Have already got a ton of dwelling fairness of their present dwelling.

- Get some monetary help from their dad and mom.

- Make a excessive revenue.

- Forsake a number of different monetary targets to make it occur.

I’d like to see a scenario the place politicians make housing their whole platform. Tear up the entire pink tape. Incentive homebuilders to construct extra properties. Supply first-time homebuyers low mortgage charges they missed out on.

Younger folks don’t have a ton of political energy so it’s not a demographic politicians are catering to. Possibly some day however not but.

Decrease mortgage charges would assist nevertheless it doesn’t look like anybody is make it a precedence to construct extra housing, which is the answer right here.

Michael and I talked about first-time homebuyers and why this isn’t but an enormous political difficulty:

Subscribe to The Compound so that you by no means miss an episode.

The Compound is coming to Chicago on June 3 for a reside present (information right here). We may also be taking conferences with shoppers and prospects on Monday June 2nd and Tuesday June third. Electronic mail information@ritholtzwealth.com to schedule a gathering with us about changing into a consumer.

Additional Studying:

When Will Housing Costs Fall?

Now right here’s what I’ve been studying these days:

Books:

This content material, which incorporates security-related opinions and/or data, is offered for informational functions solely and shouldn’t be relied upon in any method as skilled recommendation, or an endorsement of any practices, services or products. There may be no ensures or assurances that the views expressed right here will probably be relevant for any explicit information or circumstances, and shouldn’t be relied upon in any method. It is best to seek the advice of your individual advisers as to authorized, enterprise, tax, and different associated issues regarding any funding.

The commentary on this “submit” (together with any associated weblog, podcasts, movies, and social media) displays the private opinions, viewpoints, and analyses of the Ritholtz Wealth Administration staff offering such feedback, and shouldn’t be regarded the views of Ritholtz Wealth Administration LLC. or its respective associates or as an outline of advisory companies offered by Ritholtz Wealth Administration or efficiency returns of any Ritholtz Wealth Administration Investments consumer.

References to any securities or digital belongings, or efficiency knowledge, are for illustrative functions solely and don’t represent an funding suggestion or provide to supply funding advisory companies. Charts and graphs offered inside are for informational functions solely and shouldn’t be relied upon when making any funding choice. Previous efficiency shouldn’t be indicative of future outcomes. The content material speaks solely as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these supplies are topic to vary with out discover and should differ or be opposite to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Administration, receives cost from numerous entities for ads in affiliated podcasts, blogs and emails. Inclusion of such ads doesn’t represent or suggest endorsement, sponsorship or suggestion thereof, or any affiliation therewith, by the Content material Creator or by Ritholtz Wealth Administration or any of its staff. Investments in securities contain the danger of loss. For added commercial disclaimers see right here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures right here.